Our service has been carefully developed over more than 25 years with the aim of offering a guaranteed, adaptable and high added value service. Also thanks to the high demand of hundreds of clients to have a service adapted to their processes and excellent results.

Our service pillars are:

For every action a main virtue, customer orientation.

Our process is detailed and precise. We apply the best tools on the market and all our experience so that no detail is left out and the customer experience is impeccable.

We adapt the process to the policies of each company. A fully coordinated and tailored process so you can breathe easy.

⦁ Payroll preparation: (monthly variables, bonuses, arrears in the agreement, extraordinary payments, flexible remuneration, sick leave, etc.) Monthly calculation and issuance of employee payrolls, ensuring that personal income tax withholdings and social security contributions are made correctly, and that collective agreements and labour regulations are respected.

⦁ Management of extra payments: Calculation and processing of extra payments, as established in employment contracts or collective agreements.

⦁ Liquidations and final settlements: Preparation of final settlements in cases of contract termination, whether due to dismissal or resignation of the employee, ensuring that the calculation of compensation, unused vacations, and other concepts is correct.

⦁ Calculations and recalculations of personal income tax for workers Process of determining and adjusting the personal income tax withholdings applicable to employees' salaries, considering changes in their personal, professional and tax situation to ensure tax compliance and optimization.

⦁ Management of sick leave and occupational disease Supervision and processing of temporary disability (TD) and work accident (WA) leaves, ensuring correct compliance with procedures and obtaining the corresponding benefits for affected employees.

⦁ Special Regime Management Advice and administration of the particularities of the Special Social Security Regimes, such as those for self-employed workers, domestic workers or agricultural workers, ensuring regulatory compliance and the optimization of contributions and benefits.

⦁ Simulation of calculations. For both new hires and salary changes or dismissals. Process of modeling different financial or fiscal scenarios by performing calculations that allow the impact of various decisions to be predicted, thus optimizing resource planning and management.

⦁ Processing registrations and cancellations: Registration of workers with Social Security when starting a new contract, and processing of sick leave at the end of the employment relationship, whether due to termination of contract, dismissal or resignation.

⦁ Changes in employment data: Management of any changes in the working conditions of employees, such as changes in the type of contract, schedule, or salary, and communication of these changes to Social Security and other competent authorities.

⦁ Sick leave or work accidents: Processing of sick leave, common illness or work accidents, managing the payment of the corresponding benefits by the company or mutual insurance company.

⦁ Processing of Social Security for employees; sending, receiving and confirming files on Social Security contributions; managing differences between membership data and final Social Security calculations.

⦁ Management of sending the report of remuneration concepts paid (CRA).

⦁ Supervision and management of electronic notifications issued by Social Security, ensuring that self-employed workers comply with deadlines and legal obligations, avoiding penalties or surcharges.

⦁ Attendance Control. Implementation of systems to record employees' working hours, complying with regulations on control of working and rest hours.

⦁ Vacation control. Management and recording of employee vacations, ensuring compliance with labor regulations and optimizing planning to balance the needs of the company and the rights of workers.

⦁ Employee portal. We provide you with customized access to a portal that allows you to manage communications and document management with your employees.

⦁ Overtime management: Calculation and control of overtime hours worked by employees, ensuring that the conditions agreed in collective agreements or individual contracts are met.

Comprehensive advice for self-employed workers, managing tax obligations, contributions and administrative procedures, ensuring compliance with current regulations.

⦁ Obtaining a digital certificate Processing and obtaining digital certificates for self-employed workers, facilitating access to electronic procedures with the Public Administration.

⦁ Registration of self-employed workers. Management of the registration process in the Special Regime for Self-Employed Workers (RETA), including processing with the Treasury and Social Security.

⦁ Payroll of self-employed individuals, corporations, administrators with effective control. Preparation of payroll for self-employed corporate employees and administrators, with calculation of tax withholdings and social security contributions according to their specific situation.

⦁ Management of contribution bases and choice of quotas. Advice and management in choosing the most appropriate contribution base, optimising contributions based on expected income and profits.

⦁ Management of sick leave with the corresponding mutual insurance company. Processing temporary disability leave for self-employed workers, managing the process with the corresponding mutual insurance company and ensuring access to benefits.

⦁ Hiring advice: Selection of the most appropriate type of contract (permanent, temporary, internship, training, etc.) according to the needs of the company and ensuring compliance with current regulations.

⦁ Drafting of contracts and annexes: Preparation of employment contracts and annexes, adapted to applicable legislation and current collective agreements, including special clauses when necessary (trial periods, confidentiality, etc.).

⦁ Bonus Management: Identification and processing of bonuses or reductions in Social Security contributions.

⦁ Regulatory compliance: Advice on compliance with current labor legislation, ensuring that the company complies with all its obligations in terms of contracts, working hours, breaks, vacations, and salaries.

⦁ Update on legislative changes: Constant information on changes in labour legislation, ensuring that the company is up to date and correctly applies new regulations (for example, changes in the minimum wage, contribution rates, etc.).

⦁ Advice on collective agreements: Analysis of collective agreements applicable to the company and advice on their correct application in terms of salaries, working hours, vacations, and other workers' rights.

⦁ Dismissal advice and management: Legal assistance in the process of dismissing employees, including the evaluation of causes, compliance with legal procedures, negotiation of compensation and representation before labor or judicial authorities.

⦁ Assistance and representation before Labor Inspections: Support and representation of the company during labour inspections, ensuring compliance with current regulations, management of required documentation and defence of the organisation's interests before the authorities.

⦁ Immigration. Processing of work permits: Advice and management of obtaining work permits for foreigners, including preparation of documentation, compliance with legal requirements and monitoring of procedures before immigration authorities.

⦁ Newsletter of employment news: Periodic publication that informs companies about legislative changes, regulations and labor trends that may impact their business, facilitating adaptation to new regulations and best practices.

⦁ Advice on ERE and ERTE: Legal and administrative guidance on planning and implementing employment regulation procedures (collective dismissals) or temporary employment regulation files (ERTE), in case the company needs to temporarily reduce its workforce.

⦁ Negotiation with unions and workers: Representation of the company in negotiations with unions or employee representatives to reach agreements on the conditions of dismissals or reduction of working hours.

⦁ Submission of documentation: Management of all documentation required by the labour administration for the approval of the ERE or ERTE, complying with the established deadlines and procedures.

⦁ Implementation of prevention plans: Advice on the development and implementation of occupational risk prevention plans, in order to ensure that the company complies with occupational health and safety regulations.

⦁ Advice on disciplinary sanctions: Legal assistance in imposing disciplinary sanctions on employees for breaches of employment, ensuring that the procedure complies with regulations and avoiding possible claims.

⦁ Conflict Resolution: Mediation in labor disputes between the company and its employees, seeking solutions that avoid going to court and maintaining a good working relationship.

⦁ Social benefits management: Advice on the implementation of social benefits for employees, such as health insurance, pension plans, meal vouchers, transportation, among others, in compliance with tax and labor regulations.

⦁ Incentive plans: Design of variable or objective-based remuneration systems that motivate employees and are in line with the company's strategy, complying with applicable legal regulations.

⦁ Equality PlanThe Equality Plan establishes measures to guarantee equal opportunities between men and women at work, promoting an inclusive environment and eliminating gender discrimination. Mandatory for companies with more than 50 employees.

⦁ Salary Register. Record of all salary information broken down by sex and job position, group and professional category of the company's employees.

⦁ Compensation Audit. Mandatory compliance for companies with more than 50 employees.

⦁ Labor Compliance Review: Conducting internal audits to assess compliance with labor and tax obligations, identifying areas for improvement or potential non-compliance that may result in sanctions.

⦁ Labor cost analysis: Evaluating the company's labour costs, proposing measures to optimise efficiency in personnel management and reduce labour costs without compromising workers' rights.

In the area of international Payroll, what we know is that we have to meet high expectations and that there are as many service cases as there are companies.

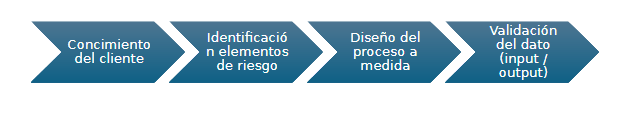

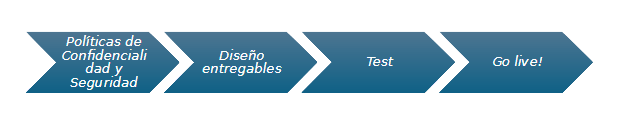

We design a roadmap and establish a service guide to meet all the company's needs for this important service. We focus on the accuracy and precision of all aspects of the service, so we implement the precise tools and processes to guarantee satisfaction and offer the confidence of a safe service.

Everything that affects the labor service from an international perspective.

⦁ Consulting on global mobility; Labor regulations and their application to displaced or transnational workers

⦁ Adaptation of foreign contracts to local regulations

⦁ Immigration; Service for obtaining work permits

⦁ Tax exemption for foreign income (7P)

⦁ Application of international social security agreements

⦁ Shadow payrolls

⦁ Payroll processes adapted to international companies

⦁ Adaptation of security measures for data protection and company communication policies.

⦁ Customized reports.

Our experience is based on serving international companies by providing the complete Payroll service, tailored to their needs in terms of language, reporting, processes, dates, adaptation of internal policies, etc., but it is also based on collaborating with highly demanding Global Payroll companies, with a high market share and VIP clients with global and very strict policies.

This has led us to become collaborators in payroll calculations, being the point of contact to resolve local labor issues, adapting to the information delivery processes in the international provider's systems and strengthening our internal processes to offer guarantees of excellence.

⦁ Report adaptation

⦁ Systems integration

⦁ Inclusion of external protocols in project management and use of proprietary platforms

⦁ Robust validation processes

⦁ Attention in English

Looking for a trusted partner to provide a global payroll service?

Talk to us!

Links of interest

Contact

Copyright 2024 © Diagonal Consulting | All rights reserved.